MRP vs ERP – What’s the Difference?

Modern products are becoming more complex exceptionally fast, with a typical new car having over 100 million lines of code, according to the MIT Technology Review. It’s common to find that 60% or more of a new product’s components are

... ContinuedFour Strategies to Optimize Production Schedules in Real Time

Market demand can seemingly shift overnight, and mid-tier manufacturers—who often supply products, parts and components to multiple industries—need to respond quickly to those shifts. That is why the ability to optimize production schedules in real time is more critical than

... ContinuedEnhancing CNC Machine Automation with MTConnect Connectivity

In today’s smart manufacturing era, digital integration and real-time data access are no longer optional—they’re essential. With the rise of Industry 4.0 and the Industrial Internet of Things (IIoT), manufacturers are facing increasing pressure to unify their systems, access machine-level

... ContinuedElevating Quality Assurance with MES and Real-Time Process Monitoring

The pressure to deliver flawless products, optimize costs, and satisfy customer demands is immense, but small and midsize manufacturing companies often struggle to maintain rigorous quality standards. Too often, these factories still rely on traditional, reactive quality assurance methods, often

... ContinuedProactive Productivity: How an MES System Enables Predictive Maintenance in Manufacturing

For managers and executives at small and midsize manufacturing companies, maintaining operational efficiency while keeping costs under control is a constant balancing act. One key to achieving this balance is ensuring equipment reliability while minimizing unexpected downtime. That means taking

... ContinuedRemoving Mental Roadblocks to Improve Manufacturing Operations

It’s a familiar scenario for many manufacturers. They have a manufacturing enterprise resource planning (ERP) system in place, but any number of features that could help them avoid a range of operational headaches are just sitting there dormant. And often

... ContinuedEnhancing Manufacturing Efficiency with MQTT and MES Connectivity

Connectivity is the backbone of modern industrial operations. With the rise of Industry 4.0 and the Industrial Internet of Things (IIoT), manufacturers face growing pressure to integrate systems seamlessly, gather actionable data, and make smarter decisions in real time. One

... ContinuedMES Integration with Smart Machines: Breaking Down Data Silos on the Plant Floor

Manufacturing businesses are experiencing a technological shift with the increasing adoption of smart machines. These devices, equipped with sophisticated sensors and machine-level intelligence, provide real-time data on their performance and process conditions. While it’s tempting to rely solely on the

... ContinuedUnderstanding the Potential Tariffs Risks: Eight Strategies for Manufacturers to Mitigate the Impact

For the past several months, the topic of increased tariffs on goods from offshore suppliers has gone from a political debate to a nearly universal discussion about best practices for planning during a period of broad tariff uncertainty. This is

... ContinuedFive Strategies for Managing Supply Chain Uncertainty

Faced with continuing inflation, manufacturers are seeking strategies to contain per-unit costs while maintaining margins. But geopolitical rivalries and an emerging wave of tariffs are introducing new levels of supply chain uncertainty. Compounding the challenge are information gaps across

... ContinuedWhat’s Next for DELMIAWorks: Exciting Updates Coming in Release 2025

Driving Manufacturing Efficiency Through Operational Excellence As the new year begins, the DELMIAWorks product team is thrilled to announce the upcoming Worldwide General Availability of Release 2025, scheduled for January 24th, 2025. The latest release features enhanced BOM management,

... ContinuedManufacturing Automation for Small and Midsize Manufacturers

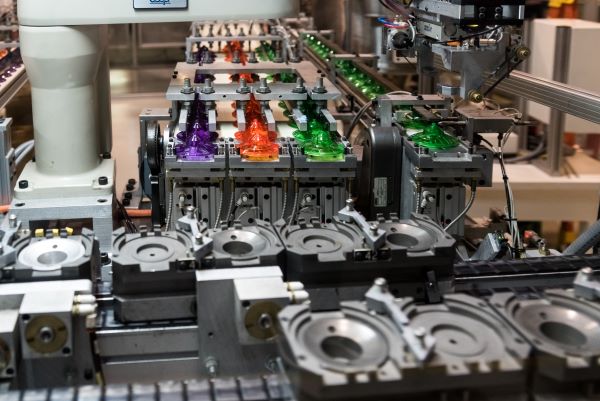

A majority of manufacturers have automated their primary manufacturing operations for producing parts and products. But when it comes to secondary operations, a huge gap remains between the largest manufacturers and many second- and third-tier component producers. Today, the manufacturing

... ContinuedThree Ways to Keep Connected to Your Production Operations

The demand for skilled manufacturing workers continues to exceed availability. In fact, a July 2024 report from the United States Bureau of Labor Statistics shows that there are 100,000-plus more manufacturing job openings each month than there are new hires.

... ContinuedWhy Automation and Robotics Are Gaining Traction in Small and Midsize Manufacturing

Automation and robotics have proven instrumental in delivering products with increased efficiency and safety across a range of industries. Yet, until recently, many small and midsize manufacturers had not fully leveraged these technologies to the same extent as larger enterprises.

... ContinuedRoadmap to IoT Success with Legacy Manufacturing Equipment

Smart machines can provide manufacturers with invaluable real-time insights into shop floor productivity, inventory, and potential quality and maintenance issues. But buying new machinery to harness the Internet of Things (IoT) can be hard to justify, especially when interest rates

... Continued